Workers will pay for the Fed’s big screw up

The worst policy error in a generation is an invitation for austerity

Thanks for reading! Like what you see? Follow us on Twitter and pass it on to friends!

November U.S. inflation figures came out on Friday at a whopping 6.8% year-over-year, the fastest rate of price increases in 39 years. Excluding volatile fuel and food costs, inflation hit 4.9% -- the worst since 1991.

At the heart of the growing crisis: the biggest Federal Reserve policy error in at least a generation. Now caught behind the curve of its price stability mandate, the world’s most powerful central bank has a clear path to fixing its mess -- one that runs right through working families.

Many different forces have come together to create the profound weirdness of this economic moment, but one primary contradiction unites them all: a reallocation shock during a time of fast-growing economic output.

Reallocation events happen routinely during recessions -- some industries and geographies get hit harder than others, causing capital to withdraw from those spaces and flow into others more quickly than labor and fixed assets can. The effects are only slowly visible because employment and demand are bad everywhere anyways.

This time, however, the reallocation was exogenous: state-mandated lockdowns and disease fears pushing demand out of services and into durable goods. Rich countries then stimulated demand at a faster rate than any normal growth pattern ever would have, exacerbating the capital mismatch. Instead of capital moving from one depressed market to another, different high-demand sectors are competing with one another for human and material inputs, bidding up their prices. Vaccines and a successful corporate conspiracy to undermine hygiene efforts then whipped demand back towards services again, accelerating the entire process.

The Fed either missed this entirely or pretended not to notice, arguing that the first wave of inflation was “transitory,” simply the result of “base effect” distortions from 2020 prices blunted by the lockdowns. The error felt intentional: as long as inflation was just an illusion, the bank could keep buying up unprecedented amounts of Treasury bonds. This artificial demand for government debt drove up bond prices, and drove down bond yields -- interest rates -- which always move inversely to prices. Lower interest rates push money out of savings and into riskier assets such as stocks, much to Wall Street’s delight.

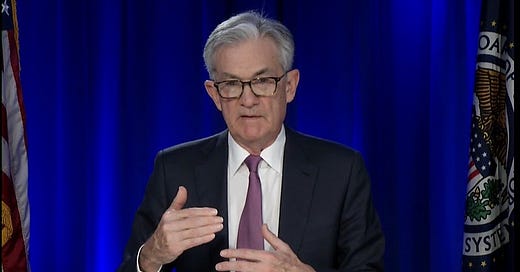

This is exactly the opposite of what central banks are supposed to do in high inflation environments. Those are the times they are supposed to raise interest rates, but the “transitory” error justified the historic mix up. Fed Chairman Jerome Powell also went out of his way to urge Congress to pass fiscal stimulus for consumers and business -- again, totally contrary to the Fed’s normal prerogatives under these conditions.

Austerity after the last downturn cracked the neoliberal consensus -- a threat to long-term corporate profits. This time they tried the opposite, but the real problems lie too deep for policy to solve.

The solution for now is all too clear. Price instability and widespread economic disruptions caused by excessive demand call for a withdrawal of demand -- a recession -- which the Fed can cue by raising interest rates. The last round of inflation 40 years ago ended with the “Volcker Shock,” an aggressive round of tightening monetary policy in 1979 and 1980 that crashed the economy to bring prices under control. Now markets anticipate the Fed raising rates at least three times next year.

That would bring the floor on interest rates up well above the “r-star” or natural rate of short-term interest, the equilibrium rate at which borrowing costs are neither stimulating nor slowing the economy. This rate has been falling for years, befuddling mainstream economists blind to the obvious culprit -- a declining rate of profit driven by the system’s internal contradictions. The slowdown would land hardest on the substantial chunk of public U.S. firms characterized as “zombie” businesses -- those only able to survive on a steady stream of debt. This includes fully 50% of all manufacturing businesses, i.e. the ones that need to grow the most to help end the inflation crisis.

In the meantime, real wages -- what workers can actually buy with their paychecks -- are plummeting, savings are eroding, and equity investments are yielding less than at any point since the 1940s, all in an election year. Whether the situation in November is the status quo decline, a new austerity recession, or another round of bailouts, popular vengeance looms.

How long can a global order based on a currency with real value in freefall, issued by a central bank that can’t be trusted, and backed by a state soon to be led by anti-democratic reactionaries in full flight from reality expect to survive? The Fed’s policy error means we’ll get to find out soon.

Disclaimer

Our only investment advice: Follow Jinx.

Contact us with thoughts, feedback, or questions.