U.S. rulers lose the empire on “Liberation Day”

Trump’s trade confusion threatens the U.S. order forever

You know we had to say something amidst this latest mess. Thanks for indulging our very occasional two cents (three after taxes). Please share with others who might appreciate the perspective.

Donald Trump’s “Liberation Day” tariff policies are the fruit of deep seated ruling class incompetence and failure. Internet sleuths discovered shortly after Wednesday’s announcement that the tariff rates the president proposed had nothing to do with tariffs or even non-tariff barriers to trade imposed by those countries. Instead, they were derived from the trade surpluses those countries have with the United States, and since then, administration officials have confirmed that the policy’s objective is to eliminate the U.S. trade deficit.

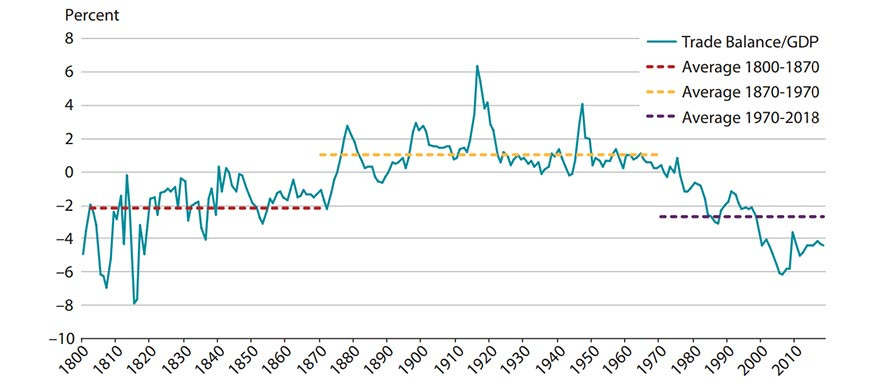

But reserve currency issuers like the United States must run trade deficits -- such deficits are the key benefit of such “exorbitant privilege.” A quick look at the history of the U.S. trade deficit shows that it started in 1970, right as Nixon closed the gold window and the global economy shifted to a greenback basis.

Cold War-era crusaders for the U.S. order fought to create a world where we have homes, cars, storage units, offices, and landfills full of literal mountains of consumer goods all made by exhausted people in other, weaker countries and all Americans have to do is print the money to buy them. We would control the highest-value ends of the manufacturing value chain -- advanced machinery, pharmaceuticals, aerospace, and weaponry -- and establish a crucial alliance with oil exporting countries to only sell these vital goods and commodities in U.S. dollars.

Countries would need dollars and could only get them by selling us those lower-value, low-margin products at prices we dictate. Trying to eliminate trade deficits amid such an order is an exercise in chasing one’s own tail. Throttling the global supply of dollars makes our exports more expensive, which only exacerbates the deficit unless imports are even more restricted -- the stated aim of Trump’s tariff policies. Selling fewer exports and buying fewer imports is another way of saying you have less money and fewer goods to buy with it: the definition of a depression. Unlike previous depressions, however, this is being done with eyes wide open, voluntarily.

Winning the Cold War cost our imperial rulers their memory of what it takes to be rich and powerful, and in this forgetfulness they are now throwing it all away.

Adding further insult to this self-injury is the notion that somehow these tariffs all will lead to a “reshoring” of manufacturing. The United States is the world’s second-largest manufacturer by value added, behind only China. Trump and his quack advisors believe that business should dedicate precious capital to lower value, lower margin industries, thus raising costs throughout the value chain and sacrificing the returns possible in a lower wage market. Not that the president or his DOGE field marshal Elon Musk are willing to lay out the kinds of subsidies necessary to actually substitute for these imports -- tariffs alone are supposed to somehow underwrite these capital expenditures, even as they raise costs on the very industrialists supposed to do the reshoring. This has never been done anywhere in history, for the simple reason that it makes no sense whatsoever.

The only possible way to make this math work would be to drive wages down to levels commensurate to those of the economies currently making all of these imported goods. So to tally up the score again, we are going to sell fewer exports, buy fewer imports, and press wages down to rates familiar in Vietnam, Indonesia, and Bangladesh. Whatever this makes of the empire, it's not “great again.”

All indications are that Donald Trump understands none of this, and that he has no concept of what the real consequences of his policy are likely to be for the empire he claims to love. In this, he reflects a common historical phenomenon. Every empire reaches a stage when the returns from routine extraction of its subject populations outrun those from any sort of innovation or industry-building, and so the imperial rulership grows torpid cashing checks off of accounts funded by an earlier generation of conquerors. They forget the brutal realism their grandparents adopted as they first built the order’s machinery, losing track of their true interests and the unflattering sources of their inherited power.

When entropy’s inevitable decay finally sets in on their state of affairs, they make gross political errors, and if they manage to survive the resulting fall out, it’s only to bide time in a way station along the empire’s ultimate, irreversible decline. It seems impossible that the world’s most powerful interests could be so foolish, but it is in fact inevitable. We are watching it all unfold live on TV right now.

Now the most important question of all: how will the rest of the world respond? At large, capital will likely press subordinate states into attempts at concession -- we are beginning to see this already. Equity markets chasing any immediate term reason to rally might even pop as Trump walks back some of the biggest, baddest tariffs, but longer-term business investment must pause as it swallows the costs of this chaos. And again, as long as Trump and his team stick to the aim of eliminating trade deficits, they will find it impossible to roll back restrictions on economies built over decades to supply us with the neverending fodder of consumerism in return for just the right to sell us even more tomorrow.

One economy, of course, is essentially immune to such pressure from capital -- China, the biggest and most important of all. In an editorial in the People’s Daily over the weekend, the party said in so many words that only the swiftness of this error has surprised them, they’ve been preparing for years to weather the storm of terminal American decadence. Their quick retaliation with massive tariffs of their own indicates their lack of intimidation, and Trump’s own reactionary obstinacy makes any near-term reconciliation all but impossible.

Even if he jerks Wall Street around by playing cute with the rest of the world, delaying and reducing duties in his own striptease of faux magnanimity, the costs of doing business with our most critical trading partner have ratcheted up for no reason, with nothing coming in return. The best case scenario is a disaster.

But if China is able to give its Global South peers an opportunity to make up much of the business lost to the United States, it could give the world’s productive classes just enough leverage to shift away from the dollar order that’s extracted the best of their energy and wealth for these long American generations. The fact that the U.S. leadership is leaned so far over their feet in this very direction now makes yanking down the dollar empire not only possible, but likely -- a reality reflected in the dollar’s recent, ominous, and unexpected decline.

For those of us enjoying the comforts of an imperial lifestyle, the costs will be impossible to avoid, but like everything else we will each learn to tolerate them. Perhaps we can assuage some of those difficulties by watching a new world being born, one where the full development of human potential becomes a new possibility. A development not so-called because these nations are now able to buy tomorrow’s garbage to distract from loneliness today, but a true reward for the collectives that held these communities together in the sad era of our brutal global empire. An era now, in chaos but in certainty, coming to an end.

Disclaimer

Our only investment advice: Revisit our greatest hit.

Contact us with any thoughts, corrections, or additional insights.