Markets blow off virus credibility gap

Plus Thiel fights emperor claims, U.S. folds on Nordstream, China fights crime

Welcome to another edition of Contention! This one should take about six minutes to read. We cover:

Markets blow off virus credibility gap

Rapid Round: Thiel’s no emperor, Nord Stream 2 lives, China turns on gangsters, for-profit schools

Know someone else smart and thoughtful with six minutes to spare? Share Contention with them!

Markets blow off virus credibility gap

Markets experienced whiplash last week as an early plunge reversed by Friday to carry all three major indexes to new record highs. The Dow advanced 1%, the S&P 500 2%, and the Nasdaq 2.8%.

But the roughest turnaround of the week was the rapid redefinition of mass expectations as the coronavirus pandemic raised its head again across the United States. The blow to official credibility could carry consequences that capital has yet to “price in.”

The week’s stock index records included the Dow’s first ever close above 35,000, its fastest ever move between 5,000 point milestones -- the benchmark hit 30,000 just 165 days earlier. Monday, on the other hand, saw the Dow’s largest one point drop since late October’s election uncertainty -- 725 points down, more than 2%

A 70% one-week rise in new coronavirus infections drove the risk sell off, with safe haven bids on Treasury bonds forcing yields -- which move inversely to prices -- down to their lowest level since February.

By Tuesday, corporate earnings season had made everything right. With reports from a quarter of the S&P 500 in, 85% have beat analyst expectations, their profits growing 76% from last year’s pandemic lows -- the best growth since 2009, the end of the last market crisis.

The rest of the week’s economic news, however, suggested that this might end up being the high water mark. On Thursday, jobless claims came in much higher than expected, hitting 419,000 vs. 350,000 forecast. This is the highest level of layoffs since May 15. Michigan led the way in new claims, with other auto-producing states seeing workers idled as the semiconductor shortage continues.

The leading economic indicator index also came out on Thursday, pointing to continued economic growth, but falling short of expectations -- a 0.7% increase vs. 1.0% predicted and 1.2% the month before. A drop in housing permits and a shrinking workweek were the major drags on the data -- the same raw material and labor shortages plaguing markets for months now. Permit numbers came out on Tuesday at an eight-month low, losing 5.1% month-over-month. Analysts expected no change and missed badly. A new National Association of Home Builders survey showed builder sentiment at an 11-month low, weighed down by soaring input costs.

“Flash” PMI reports offered the first look at July business activity on Friday, with both manufacturing and service industries still growing at historic rates. But service businesses saw their growth rate slow to its lowest point in five months, dragging the composite index down four points. Yet again, raw material and labor shortages led purchasing manager complaints, but growing consumer hesitancy in the face of a worsening pandemic situation also made this month’s report.

This trend might be concerning to markets -- high frequency data from the United Kingdom showed mobility drop 5% as the delta variant took hold there, with recent reopenings showing no effect. But that might not be the worst news for business right now: just the demand haircut the economy needs to relieve labor and pricing pressures.

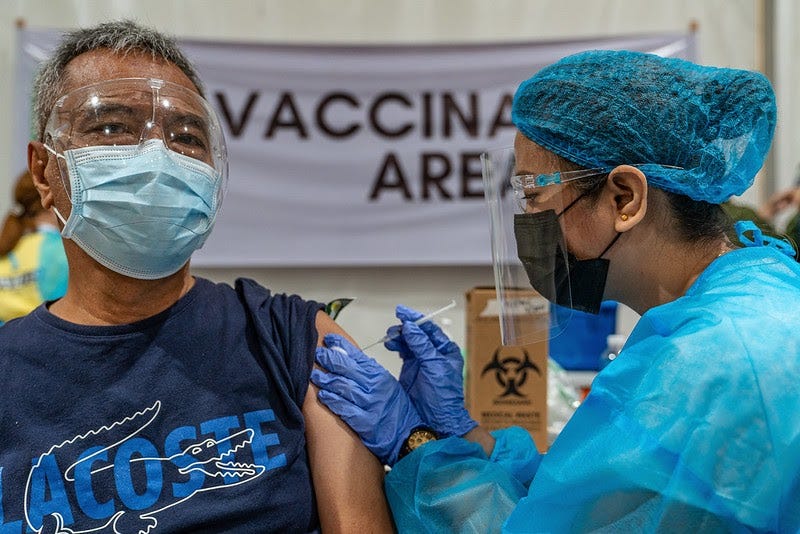

Much more worrisome: the public’s sharp, unpredictable expectations reset around the virus. Far from U.S. Pres. Joseph Biden’s quasi-declaration of independence from the virus on July 4, long-standing expert warnings that the disease is likely with us forever as an endemic illness have started to sink in. The CDC promised that vaccines would have Americans back to “normal life,” but the delta variant wave has exposed the truth: the vaccines eliminate the public health crisis while millions of people will still get very sick -- far sicker than official optimism about “severe illness” has led the public to believe.

And the CDC has no idea how big of a problem that will be because it isn’t tracking “breakthrough” cases where individuals contract the virus despite being vaccinated. There is no legitimate doubt about the vaccines’ benefits: 99.5% of all deaths are now among the unvaccinated, but even that highlights misunderstanding about how well the vaccines work. Widely reported 90%+ efficacy numbers reflect “relative risk reduction,” the benefit to focused at-risk populations. “Absolute risk reduction” numbers were always much lower -- vaccines lower overall infection risks by around 1%.

That is prompting a major “well, actually” moment for the narrative put forward by advertisers, corporate news media, and politicians for months now -- a moment that threatens to pseudo-vindicate the vaccine-hesitant. It also deepens the state’s credibility gap just as a long-predicted political crisis finally emerges: the end of eviction and foreclosure protections at the end of this week.

U.S. Census Bureau data says that 2.8 million households are behind on their rent, with 1.9 million behind on their mortgages. The National Low Income Housing Coalition predicts that six million people are at risk of eviction, with the Center for Budget and Policy Priorities estimating that three million will actually be thrown out of their homes in the next two months.

Congress budgeted $47 billion for rental assistance, but so far only $3 billion has made it to landlords amid nonstop red tape and miscommunication. Again: Americans have no institutions they can trust to actually look out for them, and millions of them are about to have nothing to lose.

Last summer saw U.S. cities erupt in unrest for weeks, much as we’re seeing around the world right now. If we don’t see more of that here in the weeks to come, it will be mostly a function of luck -- something usually only the markets get to enjoy.

Rapid Round

Palantir emperor defends crown

Palantir chairman Peter Thiel defended himself in a Delaware court last week from a shareholder lawsuit alleging Thiel -- and two other executives -- made themselves “corporate emperor for life.”

The shareholder claims Thiel and co-founders Alex Karp and Stephen Cohen pulled this trick through special “Class F” provisions that give them a 49.999999% ownership stake in the company forever even if they sell the underlying shares. That has “untethered voting power from equity ownership,” the shareholder claims, allowing the executives to make investor voters “magically appear and disappear” at will.

Thiel and the executives claimed in court that allegations they reverse-engineered the company’s stock to be a “raft of hyperbole,” and that the majority of Palantir investors approved the Class-F share structure when the data-analytics company went public last year. Palantir has made a flurry of deals in recent months ranging from the U.S. Space Force, health agencies and mining giant Rio Tinto.

U.S. buckles to Nord Stream 2

On Wednesday, the U.S. lifted its threat to block the Nord Stream 2 pipeline set to deliver Russian natural gas directly to Germany, sealing the project’s success. But the $11 billion pipeline was practically complete, meaning any U.S. sanctions would have limited effect. “Nord Stream is 99 percent finished,” U.S. Pres. Joseph Biden said. “The idea that anything that was going to be said or done was going to stop it was not possible.”

As part of a U.S. deal with Germany to clear the way for the pipeline, the countries agreed to invest €200 million into Ukraine’s energy sector -- Ukraine being a sticking point as the Nord Stream 2 pipeline bypasses the country and travels directly under the Baltic Sea. Germany also agreed to push for extending a separate Russian-Ukrainian gas transit agreement for 10 years.

China hunts crime, for-profit tutors

A widening campaign in China targeting organized crime has swept up prominent business figures and investors. One notable name: billionaire Zhang Wei, a real-estate and asset manager in Shenzhen recently convicted of running an “underworld-style” blackmail syndicate.

This campaign has also extended beyond China’s borders. Chinese police working with Interpol have swept up more than 8,000 international fugitives, many alleged to have committed financial crimes, as part of a mission known as Operation Fox Hunt. “[Chinese President] Xi is likely right that many business practices are in fact criminal and sort of bad for society,” Meg Rithmire of Harvard Business School told the Wall Street Journal.

Meanwhile, shares of Chinese education companies collapsed last week after new government regulations landed on after-school tutoring services. The regs ban foreign capital from investing in the sector through mergers and acquisitions, and forces existing companies to turn into nonprofit organizations.

China’s state guidance authority will also set prices for tutoring. One reason for the move to eliminate profit: reducing the financial burden on poorer parents and eliminating an unfair disadvantage for rich kids. “We must uphold the non-profit nature of after-school tutoring,” stated a document issued by the State Council and the Communist Party central committee.

Disclaimer

Our only investment advice: Watch season 2.

Contact us with questions, feedback, or things you think we should think about!