How for-profit developers drive up housing prices

Neither NIMBYs nor YIMBYs have an answer to monopoly developer power

Thanks for reading another edition of Contention! This will take about six minutes to read. Like what you see? Make sure you’re following us on Twitter and if you like it, please share it:

Housing costs have soared around the world over the last two years, an important factor in the recent inflationary trend. Even before the pandemic, a decade or more of gentrification had displaced populations in cities across the United States, Europe, Latin America, and Asia.

The economic orthodoxy has finally figured out what’s gone wrong: a lack of supply in housing. And they’ve even discovered the culprit for this lack of supply, namely “NIMBYs” -- short for “Not In My Back Yard,” the sorts of neighborhood preservationists who control city councils and prevent new housing from getting built. If only restrictions on real estate development could be eliminated, the market would produce more than enough housing for all.

This, of course, is completely wrong. A global phenomenon cannot be caused by local governments unless there is some global motivation uniting them. In this case, that motivation is clear: the monopoly of for-profit developers and landlords over the world’s housing stock.

Three simple facts explain why capital-driven housing markets stay throttled and prices keep climbing virtually everywhere. If policymakers care to look at them, the three facts also suggest a simple solution, one that will upset the financial interests in charge today.

1. If capital is cheap, then it is always smart to buy low-price properties and make them expensive.

Interest rates are the cost of capital -- the amount you have to pay to access future money today. For 14 years, we’ve had zero cost or even negative cost capital, and at the same time we’ve seen the most rapid and thoroughgoing gentrification in history.

This phenomenon constrains housing supply as developers simply swap out older stock with new, pricier units with no new capacity added. NIMBYism may contribute to the style of gentrification -- strict land-use codes mandating that older single-family homes become renovated single-family homes instead of apartment buildings or duplexes. But even in the absence of these regulations, market forces will limit supply and increase rents because…

2. Profit is revenue minus costs. The more expensive the property, the higher the revenue. The fewer units you build, the lower your costs. For-profit development will tend to produce fewer, more expensive properties.

We can see this empirically in the major U.S. metro area with far and away the weakest limits on building: Houston, Texas. Houston itself has no zoning ordinances at all, and some of its largest suburbs aren’t even incorporated cities: developers dominate policy-making in the sprawl-topia. No less of an expert than pop singer and Elon Musk ex-girlfriend Grimes has recently pointed to Houston as a YIMBY promised land.

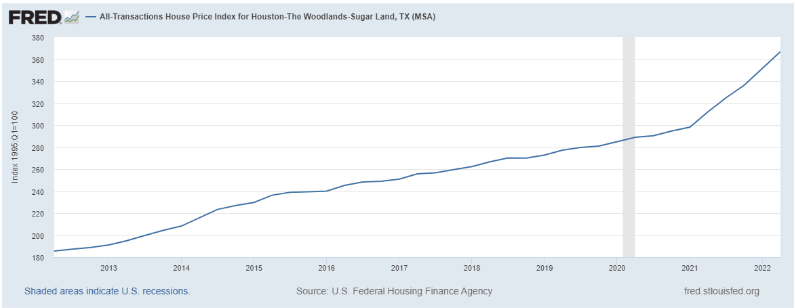

But over the last decade, housing prices have doubled in the Houston area.

True, this is significantly less than the liberal, NIMBY-friendly Austin where Grimes can only afford to live with the help of the richest man in the world. There, housing prices have effectively tripled over the same period. But for the practical purposes of working families, housing prices doubling or tripling is a distinction without a difference -- neither is sustainable.

Housing inventory data from the Federal Reserve only goes back to 2016, but over that time Houston’s inventory has dropped by 25%.

Austin’s, on the other hand, actually increased by 20%. What can explain the disconnect between supply and price? The fact that housing supply isn’t uniform -- the luxury condo building with 200 units will not serve the demand of the 100 families displaced from a trailer park torn down to build it. Supply-side housing policy doesn’t actually increase real supply.

And we can write off YIMBY notions that deregulation will spur competition to bid down prices because…

3. The investors and lenders who finance real estate development have financial stakes in real estate. They are never going to pay for projects that undermine their balance sheets.

An important point that rarely gets made in these debates: we don’t just need a slowdown in the increase in housing costs, we need them to decline. Every unhoused encampment in this country demonstrates the urgent need for lower rents right now. But the value of a rental property is a function of the rent that the landlord can collect -- lower costs means lower values.

Real estate developments cost a lot of money, and only a small number of individuals and institutions have that much capital, and only some of them focus their investments in real estate as opposed to some other market. At the point that housing supply got so saturated in a metro area that the next project would cause a decline in rents overall, investors would have an immediate need to withhold that capital. In fact, their stinginess would start long before that, and any carrying costs they incur waiting for the market to turn their way could still make them money through tax loss harvesting.

Maybe some new investors could be convinced to enter the market, but if cost declines are to be sustained, they would be putting money into assets that are going to be losing value over time. They would stop building almost as soon as they began. And as for the government providing such funding, as long as the properties they fund are in private hands, sooner or later phenomenon #1 will come into play -- there will be money to be made in making that property more expensive.

For-profit housing development and the decline of public housing are the global forces underlying the rise in housing costs nearly everywhere. The places where public housing investments have persisted -- like Vienna -- have escaped much of the crisis. And that is the most effective solution for rising housing costs, the end of the monopoly of for-profit developers over housing.

Since 1998 it has been illegal for the United States to increase the stock of public housing, a fact that official sources never mention in any analysis of the rising cost of housing over that same time period. Landlords have no fear of any meaningful consequences for raising their costs over time, and have now convinced even many “progressives” that what we really need is to eliminate the last bastion of regulations against them at the local level too.

Disclaimer

Our only investment advice: There’s nothing going on but the rent.

Contact us with questions, perspectives, feedback, or stories we might have missed.