Busy news week all about weakening recovery

Plus China’s fintech fix, Palantir’s new dig, and a bonus column hint

Thanks for reading another edition of Contention! This one will only take six minutes to read. Just like last week we are releasing a special bonus column later this afternoon, an update on the Big Short Squeeze.

In this edition we cover:

Stagnation persists, Powell downplays risks

China commits to ‘de-risking’

Rapid Round: Palantir digs in, SolarWinds hack worsens, Indian farmers’ tractor army

If you like what you see, please share it with others who might like it too (and stay on the lookout for the column later today)!

Stagnation persists, Powell downplays risks

U.S. equity markets posted their worst week since October last week, with the Dow down 2.68%, the S&P 500 3.52%, and the Nasdaq 4.67%.

We have covered the big news driving markets already, and we will have a new bonus column about the mess later today. But it would have been a busy week without that chaos, and the business stories you might have missed help explain how we got here in the first place.

U.S. fourth quarter GDP figures came out last week, reiterating the main macroeconomic theme of an incomplete recovery getting even weaker. Growth came in at an annualized rate of 4.0% vs. 4.3% anticipated. The 3.5% GDP drop in 2020 was the worst since World War II demobilization in 1946.

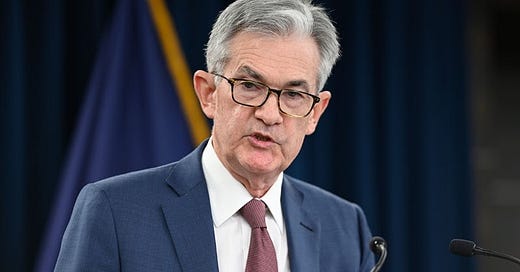

Federal Reserve Chairman Jerome Powell described the situation as a “moderated” recovery following the Fed’s Wednesday meeting. Powell said the bank would hold the line on near-zero interest rates and monthly $120 billion Treasury bond purchases.

Powell also downplayed any Fed responsibility for the present bubble economy, pointing to the spread between S&P 500 earnings yield and 10-Year Treasury bonds to show that stocks aren’t overbought right now. A stock’s earnings yield flips its price-to-earnings ratio on its head, so amped-up stock prices mean a lower yield. The smaller the difference between this number and the yield on a risk-free bond, the riskier the market is getting. Powell noted that in the 2000 dot-com bust this spread was at zero, and it’s at 5.6 today.

But what would the spread be if the Fed wasn’t suppressing interest rates? No doubt it would be narrower, which by definition means that Powell is downplaying this risk.

For now, however, the bubble persists, and three of its tech megacap champions reported Q4 earnings last week:

Apple broke revenue records, earning $111.4 billion in a single quarter led by huge growth in its services sector.

Microsoft beat on earnings and revenue expectations with 50% growth in its Azure cloud business.

Facebook’s earnings and revenue both beat expectations, but its stock lost 3.5% on warnings that coming Apple iOS privacy updates will blunt their ad revenue.

All three stories share the same theme: investor love for high operating leverage, i.e. high fixed costs and low variable costs. It takes some expensive servers to host AppleTV, Azure, or Facebook, but the cost of servicing each new subscription, hosting agreement, or ad is near zero.

The problem, as we explained in September, is this makes the overall economy less profitable over time, making Fed gimmicks and other debt plays more necessary. The result: bubbles and stagnation.

Bubble bursts may make for better TV, but they start on corporate balance sheets and in Fed meetings. If the busy news week taught us anything, it’s that few will connect all these dots before it’s too late.

China commits to de-risking

The Wall Street Journal reported last week that Ant Group -- the fintech arm of China’s largest company, Alibaba, would soon restructure as a simple financial holding company, closely regulated by the People’s Bank of China (PBOC), the country’s central bank. The week before saw Alibaba founder Jack Ma’s first public appearance since Chinese regulators canceled Ant’s IPO in October.

The restructure is just the most visible facet of a new Chinese strategy to reduce financial risk in its rapidly changing economy. Economic indicators already suggest these steps might pay off sooner rather than later.

The Communist Party of China’s executive Politburo and its main economic planning arm, the Central Economic Work Conference, both elaborated de-risking strategies last year. Fintech is one piece of this strategy, the most visible in Western news. New PBOC draft rules released last week will restrict payment companies -- like Alibaba and Tencent -- from accumulating monopoly market shares.

This benefits local banks over multinational giants, but the smaller banks pose their own risks. Since last year the government has pushed for recapitalization and consolidation among overextended institutions. The PBOC has now authorized new “perpetual bonds” to help smaller banks raise capital without committing to risky expiry dates, secured with equity conversions to protect investors.

Local governments are another piece of this puzzle, and the Party may relieve their financial pressures with one of its most dramatic moves to date: giving up annual GDP growth targets. Financing growth projects to meet these targets has forced many local governments into debt, and the country’s leaders hope giving up on explicit targets will drive a move to “quality growth” as opposed to simply hitting the numbers.

Finally, China has begun to see payoff from its high-profile push to rein in real estate speculation. The PBOC issued its “Three Red Lines” rule last year, barring developers from borrowing money if they fell outside certain debt to asset, debt to equity, or cash to short-term debt boundaries. Last week, the country’s largest developer -- and poster child for risky debt -- Evergrande Properties bought a major property services firm to shore up its cash position.

The red lines are not just a financial measure: central government ministries have told local governments that “housing is for living” and that providing adequate, affordable housing for all their residents is their “main responsibility.” Local officials are experimenting with a variety of mechanisms for meeting this obligation, with Shenzhen building 180,000 new public housing units this year alone.

According to mainstream western economics, this heavy-handed state intervention in the market should be a disaster for China. Instead, the country lapped the United States as the number one destination for foreign investment last year. The last two weeks, not to mention the last 10 months, certainly seem to paint a big contrast on which way of doing things is best equipped to handle the risks of a changing world economy.

Rapid Round

Worst hack ever gets even worse

The mega "supply chain" hack which targeted Texas-based software company SolarWinds is worse than it first appeared as new data revealed 30 percent of firms and institutions targeted had no connection to SolarWinds at all. Instead, the hackers appear to have seized email passwords to accounts before penetrating Microsoft's cloud authentication software, which then gave the intruders a backdoor into SolarWinds and a swath of major companies.

The hack also preceded SolarWinds’ adoption of its Orion software, previously suspected to have been the hackers’ origin into U.S. networks.

The U.S. government suspects the hackers to have been tied to Russia's Foreign Intelligence Service. Whoever did it, they had nine months to make off with critical information from within Fortune 500 companies, the U.S. military and the DOE's National Nuclear Security Administration, among other agencies. In another twist, the same hackers breached computer security company Malwarebytes, which has no ties to SolarWinds at all.

There’s little doubt the hack is the biggest act of cyber spycraft in history, and it will take years to discover the scale of the breach. The winners are clear: those with the interest in breaking the U.S. monopoly over the world’s top tech secrets.

Palantir goes underground

The CIA-funded, data-mining juggernaut Palantir signed a multi-year contract on Thursday with Australia's Rio Tinto, the world's second largest mining corporation. The agreement states that Palantir's software will integrate the miner's underground data streams together with Rio Tinto's offices while assisting the company during the COVID pandemic. In combination, Palantir says it will merge Rio Tinto's data into a "single point of truth."

Rio Tinto has a long history of human rights abuses and involvement in violent civil conflicts in Africa.

The contract was more good news for Palantir, however, which saw its stock price soar last week until being caught in the headwinds of the short-squeeze craze centered on GameStop.

Meanwhile, Palantir is coming under further scrutiny for its data harvesting practices in close collaboration with police departments. The firm has gained in this sector through its software packages such as Palantir Gotham, allowing cops to search through vast amounts of people's personal information with just a few clicks -- and with Palantir engineers working directly in hunting down suspects.

"They’re going to take over the world. I promise you, they're going to take over the world," one enthusiastic Los Angeles police sergeant told University of Texas sociologist Sarah Brayne in her new book covering the firm.

Tractors advance on New Delhi

More than 10,000 tractor-driving farmers flocked into India's capital last Tuesday. It was the latest act in a five-month-long rebellion that has rattled Prime Minister Narendra Modi's plans to adopt an array of laissez faire agricultural laws. India's Supreme Court has delayed the laws, but the government has not repealed them -- the key demand behind the protests.

The uprising is occurring during a historic economic crisis for India and government inaction which we have previously reported to have combined the worst of both worlds; timidity toward spending to support the productive economy and callousness toward the unemployed. Now the Finance Ministry meets in February to decide the next budget, but meaningful fiscal stimulus is unlikely.

“Going by the evidence thus far … a truly game-changing budget can be ruled out, desperate though is the nation’s need for it,” economist Surajit Mazumbar wrote. “The game was already loaded heavily in favor of big business and the wealthy and became (or rather was made) even more so during the last year.”

Perhaps massive, enduring protests will educate India's government on a different perspective. We’ll be watching.

Disclaimer

Our only investment advice: Not this.

Contact us with questions, feedback, or stories we might have missed.